Free South Carolina Pt 401 PDF Template

The South Carolina PT-401 form serves as a critical document for individuals and organizations seeking tax exemption on various types of property within the state. Mandated to be filled with diligent detail by either the property owner or their designated agent, this form is the gateway to securing exemptions that could significantly alleviate financial burdens. Notably, the form encapsulates a broad spectrum of categories ranging from real estate and vehicles to property owned by religious, charitable, educational, or certain non-profit organizations. The state’s Department of Revenue mandates the submission of supporting documents such as deeds, titles, registration cards, IRS Determination Letters, and financial statements, underscoring the stringent validation process. Moreover, specific segments offer relief to veterans, law enforcement officers, firefighters, and individuals with disabilities, highlighting a societal recognition and reward for service and confronting adversity. The array of exemptions stretches further to include entities that bolster economic development, health, education, and cultural enrichment, through provisions for housing corporations, community services, and artistic ventures. As a crucial conduit for tax relief, the meticulous completion and submission of the PT-401 form to the South Carolina Department of Revenue, along with the requisite annexures, is a procedural necessity that promises significant financial reprieve, underpinned by a complex tapestry of eligibility criteria aimed at fostering societal welfare and development.

Document Preview

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

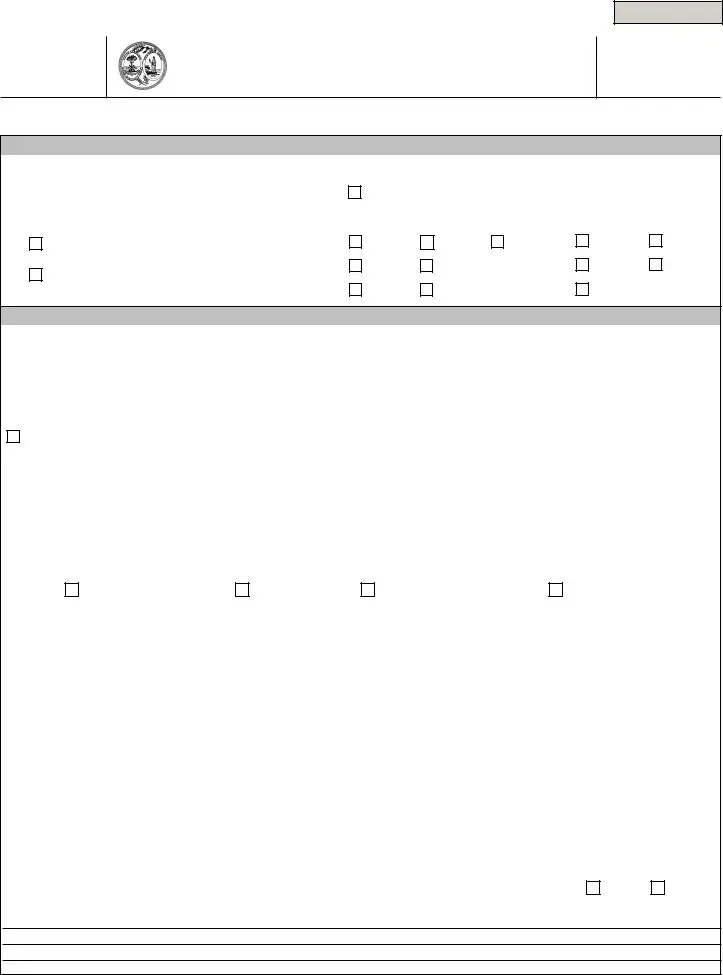

PROPERTY TAX EXEMPTION

APPLICATION FOR INDIVIDUALS

(Rev. 7/1/22)

7092

MyDORWAY is the fastest, easiest way to apply for Property Tax Exemptions. If you apply for a Property Tax Exemption on MyDORWAY, you do not need to submit a paper copy of the

Section A: Exemption information

1. |

Exemption year: |

3. Exemption section (see instructions): |

|

|||||||||||||||

|

|

|

|

|

|

|

|

Applying as a surviving spouse |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. |

Property type: |

Real property: |

|

|

|

|

|

Personal property: |

|

|||||||||

|

|

|

|

Real property (Section C) |

|

|

B(1)(A) |

|

|

B(1)(D) |

|

B(43) |

|

|

B(3) |

|

B(29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|||||||||||||||

|

|

|

|

Personal property (Section D) |

|

|

B(1)(B) |

|

|

B(2)(A) |

|

|

|

|

B(26) |

|

B(37) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

B(1)(C) |

|

|

B(2)(B) |

|

|

|

|

B(27) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section B: General Information

4. Owner information: |

|

|

|

|

|

|

|

|

5. Deceased spouse information (if applicable): |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Date of birth |

|

|

Phone |

|

SSN |

|

Date of birth |

|

|

|

Date of death |

|||||||||

|

|

|

New address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

Street address of former marital residence |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

City |

|

|

State |

|

|

ZIP |

|

City |

|

|

|

State |

|

|

|

ZIP |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C: Real Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Exemptions applied for (land only not available for individuals):

|

|

|

|

Land and building |

|

|

|

|

|

Building |

|

|

Land and mobile home |

|

|

Mobile home |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Property information: (complete all applicable fields) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

Mobile home tax map number |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Date acquired |

|

|

Tax map number |

|

|

Number of acres |

|

|

Mobile home year/make |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Physical address |

|

|

|

|

|

|

|

|

County |

|

|

Mobile home permit number |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

City |

|

State |

|

|

|

ZIP |

|

|

Deed book/page number |

|

Date mobile home purchased |

|||||||||||||||

8. |

Explain the use of the property, land, and buildings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Example: primary dwelling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

9. |

Do any other individuals, associations, or corporations occupy or use any part of this property? |

|

|

Yes |

|

No |

|||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

|

|

If yes, explain the circumstances. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

70921028

Section C: Real Property (cont'd)

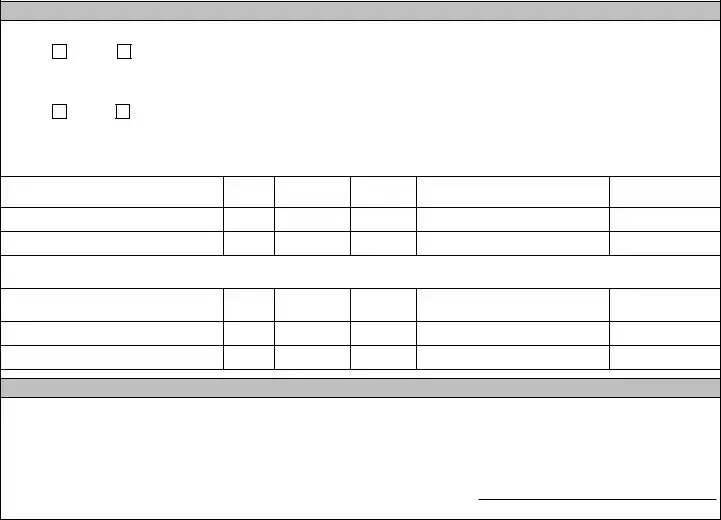

10. Do you receive any rent for this property?

|

Yes |

|

No |

If yes, from whom? |

|

|

|

|

|

|

|

11. Do you lease or rent this property?

|

|

Yes |

|

No |

If yes, from whom? |

|

|

|

|

||||

|

|

|

|

|

|

|

Section D: Personal Property |

|

|

||||

|

|

|

|

|

|

|

12. Complete the chart below to apply for vehicle exemption:

Vehicle Identification Number

Type

Make

Year

Registered Owner

County of

Registration

13. List any vehicles to be removed:

Vehicle Identification Number

Type

Make

Year

Registered Owner

County of

Registration

Section E: Declaration of Owner or Owner's Agent

I understand that a misstatement or concealment of fact in an application is sufficient grounds for the denial of this application for exemption.

Under penalties of perjury, I declare and affirm that I have read and understood this form, and the information I have provided is true, correct, and complete.

Signature |

|

Date |

Important Reminders

•If you leave the Exemption year requested blank, it will default to the current year.

•Claims for exemptions must be received within 2 years from the date taxes were paid.

•Real estate taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

•If you are requesting refunds for 2 years, you must include the paid tax receipts.

•You will need to reapply if there is

Oa change in status, or

Oa change in ownership of previously exempted property

Send in your application using one of the following ways:

Mail to: SCDOR, Government Services Division, PO Box 125, Columbia, SC

Apply using our free online tax portal, MyDORWAY. Visit dor.sc.gov/MyDORWAY to get started.

We also accept applications in person at any of our service centers. Visit

Questions? We're here to help. Email us at Property.Exemptions@dor.sc.gov

70922026

INSTRUCTIONS

MyDORWAY is the fastest, easiest way to apply for Property Tax Exemptions. If you apply for a Property Tax Exemption on MyDORWAY, you do not need to submit a paper copy of the

If you've never created a MyDORWAY account, visit

•Your FEIN, SSN, or South Carolina ID (SID)

•One of the following:

OLast Payment Amount O Last Refund Amount

O Line 1 from the Last Return

O Letter ID - Displayed on all SCDOR correspondence

Once you've created a MyDORWAY account and logged in, click the More tab, then select Request Property Exemption, located under the Other section.

EXEMPTION SECTIONS:

Required documentation is listed for each exemption.

Real Property (Land and Home) Exemptions for Individuals

B(1)(A) - Dwelling home of a veteran who is permanently and totally disabled as a result of a

A veteran who is totally and permanently disabled from a

•Certificate from VA or Local County Service Officer certifying total and permanent

•Recorded deed

•Documentation that the 4% special assessment ratio for an

•Your marriage certificate if the home is jointly titled with a spouse

•Title, bond for title, or bill of sale if the property is a mobile home

A surviving spouse may apply for this exemption for the dwelling home they acquired from the deceased spouse, as long as the spouse remains unmarried, resides in the house, and owns the house in fee or for life.

If you are applying as a surviving spouse, provide copies of the following:

•Documentation from the VA showing that you are the survivor of the veteran

•Veteran's death certificate

•Recorded deed of distribution, or last will and testament

•Documentation that the 4% special assessment ratio for an

•Title, bond for title, or bill of sale if the property is a mobile home

B(1)(B) - Dwelling home of a former law enforcement officer, who is permanently and totally disabled as a result of a law enforcement

A former law enforcement officer who is totally and permanently disabled as a result of their law enforcement service- connected disability may apply for a Property Tax exemption for a dwelling home they own solely, in fee or for life, or jointly with a spouse. Provide copies of the following:

•Documentation from commanding officer certifying that the applicant was totally and permanently disabled in the line of duty in South Carolina, with the effective date

•Final order issued by Workers’ Compensation Commission of total and permanent

•Recorded deed

•Documentation that the 4% special assessment ratio for an

•Your marriage certificate if the home is jointly titled with a spouse

•Title, bond for title, or bill of sale if the property is a mobile home

A surviving spouse may apply for this exemption for the dwelling home they acquired from the deceased spouse, as long as the spouse remains unmarried, resides in the house, and owns the house in fee or for life.

If you are applying as a surviving spouse, provide copies of the following:

•Documentation from commanding officer certifying that the South Carolina law enforcement officer was killed in the line of duty in South Carolina

•Officer's death certificate

•Recorded deed of distribution, or last will and testament

•Documentation that the 4% special assessment ratio for an

•Title, bond for title, or bill of sale if the property is a mobile home

B(1)(C) - Dwelling home of a former firefighter, including volunteer firefighter, who is permanently and totally disabled as a result of a firefighting

A former firefighter or volunteer firefighter who is totally and permanently disabled as a result of their firefighting service- connected disability may apply for a Property Tax exemption for a dwelling home they own in fee or for life, or jointly with a spouse. Provide copies of the following:

•Documentation from the fire department chief certifying the applicant was totally and permanently disabled in the line of duty in South Carolina, with the effective date

•Final order issued by Workers’ Compensation Commission of total and permanent

•Recorded deed

•Documentation that the 4% special assessment ratio for an

•Your marriage certificate if the home is jointly titled with a spouse

•Title, bond for title, or bill of sale if the property is a mobile home

A surviving spouse may apply for this exemption for the dwelling home they acquired from the deceased spouse, as long as the spouse remains unmarried, resides in the house, and owns the house in fee or for life.

If you are applying as a surviving spouse, provide copies of the following:

•Documentation from the fire department chief certifying that the South Carolina firefighter was killed in the line of duty in South Carolina

•Firefighter's death certificate

•Recorded deed of distribution, or last will and testament

•Documentation that the 4% special assessment ratio for an

•Title, bond for title, or bill of sale if the property is a mobile home

B(1)(d) - For the above B(1)(A), B(1)(B), and B(1)(C) Property held in a Trust

When a trustee holds the legal title to a dwelling for a beneficiary and the beneficiary qualifies for the exemption and uses the dwelling as their primary residence, the dwelling is exempt from property taxation. Provide copies of the following:

•The same documentation listed above for B(1)(A), B(1)(B), and B(1)(C)

•A copy of the signed trust agreement verifying the applicant is the income beneficiary

•Documentation that the beneficiary has been granted the 4% special assessment ratio for an

B(2)(a) - Dwelling home of a paraplegic or hemiplegic person

A paraplegic or hemiplegic person may apply for a Property Tax exemption for a dwelling home and a lot up to one acre that they own solely or jointly with a spouse. For purposes of this exemption, "paraplegic" or "hemiplegic" includes a person with Parkinson's disease, Multiple Sclerosis, or Amyotrophic Lateral Sclerosis, which has caused the same ambulatory difficulties as a person with paraparesis or hemiparesis. Provide copies of the following:

•Signed physician’s statement on the physician’s letterhead certifying the paraplegic or hemiplegic condition OR certifying that the Parkinson's disease, Multiple Sclerosis, or Amyotrophic Lateral Sclerosis has caused the same ambulatory difficulties as mentioned above, including the effective date of ambulatory difficulties

•Recorded deed

•Documentation that the 4% special assessment ratio for an

•Your marriage certificate if the home is jointly titled with a spouse

•Title, bond for title, or bill of sale if the property is a mobile home

A surviving spouse may apply for this exemption for the dwelling home they acquired from the deceased spouse, as long as the spouse remains unmarried, resides in the house, and owns the house in fee or for life.

If you are applying as a surviving spouse, provide copies of the following:

•Former applicant's death certificate

•Recorded deed of distribution, or last will and testament

•Documentation that the 4% special assessment ratio for an

•Title, bond for title, or bill of sale if the property is a mobile home

B(2)(b) - For the above B(2)(a) Property held in a Trust

When a trustee holds the legal title to a dwelling for a beneficiary and the beneficiary qualifies for the exemption and uses the dwelling as their primary residence, the dwelling is exempt from property taxation. Provide copies of the following:

•The same documentation listed above for B(2)(a)

•A copy of the signed trust agreement verifying the applicant is the income beneficiary

•Documentation that the beneficiary has been granted the 4% special assessment ratio for an

B(43) - Dwelling home of a Medal of Honor or Prisoner of War recipient

A Medal of Honor recipient or Prisoner of War in World War I, World War II, the Korean Conflict, or the Vietnam Conflict may apply for a Property Tax exemption for a dwelling home and a lot up to one acre that they own solely or jointly with a spouse. Provide copies of the following:

•Certificate from VA or Local County Service Officer certifying you are a recipient of the Medal of Honor or that you were a Prisoner of War

•Recorded deed

•Documentation that the 4% special assessment ratio for an

•Your marriage certificate if the home is jointly titled with a spouse

•Title, bond for title, or bill of sale if the property is a mobile home

A surviving spouse may apply for this exemption for the dwelling home they acquired from the deceased spouse, as long as the spouse remains unmarried, resides in the house, and owns the house in fee or for life.

If you are applying as a surviving spouse, provide copies of the following:

•Documentation from the VA showing that you are the survivor

•Former POW or Medal of Honor recipient's death certificate

•Recorded deed of distribution, or last will and testament

•Documentation that the 4% special assessment ratio for an

•Title, bond for title, or bill of sale if the property is a mobile home

Personal Property (Vehicle) Exemptions for Individuals

Vehicles must be registered with the South Carolina Department of Motor Vehicles (SCDMV) prior to applying for exemptions. If the vehicle is registered or purchased out of state, you must pay vehicle taxes up front. If the exemption is granted, the applicant may seek reimbursement from the county where the taxes were paid.

If you have previously been approved for an exemption and are adding or removing a vehicle, Veterans Administration (VA) documentation is not necessary.

If you are applying for a vehicle exemption, provide copies as defined for your specific exemption.

A marriage certificate must be provided for jointly titled vehicles. Prior to November 2018, this was not a requirement.

B(3) - Vehicle exemption for Disabled Veterans

A veteran who is totally and permanently disabled from a

•Certificate from VA or Local County Service Officer certifying total and permanent

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title

•Your marriage certificate if the vehicle is jointly titled with a spouse

Effective for tax year 2015, a surviving spouse may apply for this exemption for one vehicle they own or lease, for their lifetime or until their remarriage. Surviving spouses are allowed an exemption for only one vehicle.

If you are applying as a surviving spouse, provide copies of the following:

•Veteran's death certificate

•Documentation from the VA showing that you are the survivor of the veteran

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title showing that you are the sole owner of the vehicle

B(26) - Vehicle exemption for Medal of Honor recipients

Medal of Honor recipients may apply for a Property Tax exemption for two private passenger vehicles that they own or lease. Provide copies of the following:

•Certificate from VA or Local County Service Officer certifying receipt of Medal of Honor

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title

•Your marriage certificate if the vehicle is jointly titled with a spouse

If you have previously been approved for this exemption and are adding or removing a vehicle, provide a copy of the South Carolina vehicle registration card; or bill of sale; or title.

B(27) - Vehicle exemption for persons required to use wheelchairs

Persons required to use a wheelchair may apply for a Property Tax exemption for two personal motor vehicles that they own or lease, either solely or jointly. Provide copies of the following:

•Signed physician’s statement on the physician’s letterhead certifying the required use of a wheelchair on a permanent basis, with effective date of permanent wheelchair use (must be from a South Carolina licensed physician)

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title

B(29) - Vehicle exemption for Prisoner of War

A Prisoner of War (POW) in World War I, World War II, the Korean Conflict, or the Vietnam Conflict may apply for a Property Tax exemption for two private passenger vehicles (not exceeding

•Certificate from VA or Local County Service Officer certifying you were a Prisoner of War

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title

•Your marriage certificate if the vehicle is jointly titled with a spouse

A surviving spouse may apply for this exemption for one vehicle they own or lease, for their lifetime or until their remarriage. Surviving spouses are allowed an exemption for only one vehicle.

If you are applying as a surviving spouse, provide copies of the following:

•Former POW's death certificate

•Documentation from the VA showing that you are the survivor of the qualified former POW

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title showing that you are the sole owner of the vehicle

If you have previously been approved for this exemption and are adding or removing a vehicle, VA documentation is not necessary.

B(37) – Vehicle exemption for parent or legal guardian of a minor child who is blind or requires the use of a wheelchair

A parent or legal guardian of a minor who is blind or requires the use of a wheelchair may apply for a Property Tax exemption for one personal motor vehicle that they own or lease, provided the vehicle is used to transport the minor. Provide copies of the following:

•Signed physician’s statement on the physician’s letterhead certifying the minor is blind or required to use a wheelchair, with effective date (must be from a South Carolina licensed physician)

•The minor's original birth certificate showing parents' names, or court documentation of legal guardianship

•South Carolina vehicle registration card; or South Carolina bill of sale; or South Carolina issued title

If you have previously been approved for this exemption and are adding or removing a vehicle, documentation of legal guardianship and certification of the minor's disability is not necessary.

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Completeness | All applicable areas of the PT-401 form must be filled out for the application to be accepted. Incomplete applications will be returned, which may delay the review process. |

| Mailing Address | Completed forms should be mailed to the South Carolina Department of Revenue, Property Division, in Columbia, South Carolina. |

| Required Information | The application requires details such as legal owner's name, address, Social Security or Federal Identification Number, property location, tax map number, and details about the exemption being requested. |

| Governing Law | The exemptions outlined in the PT-401 form are governed by South Carolina Code Section 12-37-220, detailing specific criteria for exemption eligibility based on the type of property and ownership. |

Guidelines on Filling in South Carolina Pt 401

The process of applying for a tax exemption in South Carolina involves completing the PT-401 form. This document is critical for organizations, veterans, and individuals who meet specific criteria to possibly reduce or eliminate their property tax obligations. The steps to properly fill out this form are outlined below, ensuring clarity and a better chance for a swift approval process. It is important to gather all necessary documentation beforehand, including titles, financial statements, and certification letters, as they need to be submitted along with the completed form.

- Enter the legal owner’s name, address, social security number, or federal identification number in the designated space.

- Indicate the year(s) you are applying for the exemption.

- If the exemption request is for real property, specify the date the real estate was acquired.

- List the SC Code Section that applies to your exemption claim (see instructions for the corresponding section).

- Include the county where the property is located or registered.

- Provide the location of the property, if it differs from the mailing address.

- Enter the tax map number, which you can obtain from your county assessor’s office.

- If applying for a real estate exemption, check the applicable boxes to describe the property.

- List the deed book and page number, information which is also available from your county assessor.

- For vehicles, include all requested details such as the vehicle identification number (VIN), type of vehicle, make, and year. Use the designated types (e.g., Automobile-01, Bus-02) for identifying the vehicles.

- For organizations applying for an exemption for furniture and fixtures, attach a separate sheet with details including type, date of acquisition, cost at acquisition, accumulated depreciation, and net value.

- Review the classifications of exempt property to ensure your eligibility and gather the required documents, such as deeds, registration cards, IRS Determination Letter, Articles of Incorporation, Bylaws, financial statements, and any other documents listed under the relevant classification.

- Mail the completed application along with all the required document copies to the South Carolina Department of Revenue, Property Division, Columbia, South Carolina 29214-0303.

By following these steps carefully, you can submit a complete application for a tax exemption. Remember, incomplete applications may be returned, delaying the process. Therefore, double-check each step as you go along to ensure you have filled out every applicable section and attached all required documents.

Common Questions

What is the PT-401 form used for in South Carolina?

The PT-401 form, known as the "Tax Exemption Application" in South Carolina, is utilized by property owners or their agents to apply for tax exemptions on various types of property, including real estate, vehicles, and personal property. The exemptions apply to certain qualifying schools, charitable institutions, public libraries, churches, and other specific organizations and circumstances outlined by state law.

Who needs to fill out the PT-401 form?

This form must be completed by the legal owner of the property or an authorized agent seeking a tax exemption under the specified guidelines for properties located within South Carolina.

What information is required to complete the PT-401 form?

To correctly fill out the PT-401 form, detailed information about the property including the legal owner's name, address, Social Security Number or Federal Identification Number, the year(s) the exemption is applied for, property location, and specific details according to the property type (such as vehicles' make and year or real estate's acquisition date) are required. Additionally, tax map numbers, relevant SC Code sections for exemption qualifications, and supplementary documentation like deeds, vehicle registration cards, IRS Determination Letters, and financial statements are needed.

Where should the completed PT-401 form be sent?

Upon completion, the PT-401 form should be mailed to the South Carolina Department of Revenue, Property Division, in Columbia, South Carolina. The exact mailing address is provided within the form’s instructions.

What happens if the PT-401 application is incomplete?

Incomplete applications will be returned to the applicant. This return leads to delays in the consideration of the tax exemption application, so it's important to ensure all requested information is provided and the form is fully completed before submission.

Can an exemption be requested for vehicles through the PT-401 form?

Yes, exemptions for various types of vehicles owned by qualifying individuals or organizations can be requested using the PT-401 form. Specific information such as the Vehicle Identification Number (VIN), make, and year of the vehicle, along with the appropriate documentation, must be included in the application.

Are real estate properties eligible for tax exemption under the PT-401 application?

Real estate properties may qualify for a tax exemption if they are owned by eligible schools, charitable institutions, religious organizations, and certain other entities defined by South Carolina law. Applicants must provide detailed information about the property, including deed or title, and the property's use must align with the exemption criteria.

What additional documents are required to support the PT-401 application?

Depending on the type of property and exemption being applied for, supplementary documents such as deeds or titles, vehicle registration cards, bills of sale, IRS Determination Letters, Articles of Incorporation, Bylaws, financial statements, and other relevant information may be required to validate the exemption request.

How are organizations applying for exemptions for furniture and fixtures required to proceed?

Organizations applying for exemptions for furniture and fixtures must attach a separate sheet to the PT-401 application, identifying each item, the date of acquisition, cost at acquisition, accumulated depreciation, and the net value. This information is crucial for evaluating the exemption request for such items.

Who qualifies for the tax exemption as an "eligible owner" under Section B(1) of the PT-401 instructions?

Eligible owners qualifying for a tax exemption include veterans with a 100% total and permanent service-connected disability, former law enforcement officers, and former firefighters who have been permanently and totally disabled due to their service. Eligibility extends under certain conditions to their surviving spouses. Required proof of disability and ownership must be submitted with the application.

Common mistakes

Failing to provide all necessary identification details: The form mandates the inclusion of the legal owner's name, address, and either a social security number or a federal identification number. Overlooking or incompletely filling this section can result in the denial of the application. Moreover, for entities or individuals applying for multiple years, indicating the year(s) for which the exemption is sought is crucial. Omitting this information can lead to processing delays or the outright return of the application.

Not specifying the property details accurately: Whether the exemption is for real property or vehicles, the form requires precise information, such as the date of acquisition for real estate, the property's location if different from the mailing address, and the tax map number — which is available from the county assessor. Similarly, for vehicles, the correct identification number (VIN) — not the license tag number — along with the make and year must be provided. This detailed information is critical for the Department of Revenue to assess the application correctly.

Inadequate documentation for the type of exemption claimed: Depending on the exemption classification under SC CODE SECTION 12-37-220, applicants must provide supporting documents such as property deeds or titles, vehicle registration cards, IRS Determination Letters, and financial statements from the past three years, among others. Applicants often fail to attach all the required documents, leading to the return of their applications.

Overlooking specific requirements for certain exemptions: Certain exemptions have very specific requirements. For example, veterans, law enforcement officers, or firefighters applying for exemptions based on disability must submit documentation according to the specified criteria, such as a certificate of 100% total and permanent disability. Misinterpreting these requirements or submitting incomplete documentation can lead to application denial.

Inaccurate or incomplete listing of furniture, fixtures, or other extra items: For organizations applying for exemptions on furniture and fixtures, the form stipulates that a separate sheet should identify item(s), date of acquisition, cost at acquisition, accumulated depreciation, and net value. However, filers sometimes miss listing these details comprehensively, which can affect the consideration of their exemption status.

It is essential for filers to approach the completion of the South Carolina PT-401 form with attention to detail and a thorough understanding of the specific requirements for their type of exemption. Ensuring accuracy in all sections of the form and including all necessary documentation can expedite the processing time and increase the likelihood of approval.

Documents used along the form

When individuals or organizations in South Carolina are completing the PT-401 form for tax exemption applications, they often need to compile additional documentation to support their application. These documents range from legal titles and financial statements to specific certifications. The nature of these documents underscores the importance of thoroughness and accuracy in applying for tax exemptions, making the process both a legal and bureaucratic undertaking.

- Deed or Title to Real Property: This document proves ownership of real estate. It is crucial when applying for exemptions on properties used for specific exempt purposes outlined in the PT-401 instructions.

- Vehicle Registration Card/Bill of Sale or Title: For exemptions involving vehicles, such as those owned by disabled veterans or nonprofit organizations, these documents serve as proof of ownership and the vehicle's details.

- IRS Determination Letter: This is a letter from the Internal Revenue Service confirming the organization's tax-exempt status. It is necessary for justifying exemptions related to nonprofit status under specific classifications within the PT-401 instructions.

- Articles of Incorporation/Bylaws: These documents define and regulate the organization's operations, governance, and purpose. They are required to establish the eligibility of charitable, educational, or other organizations claiming tax exemptions.

- Audited Financial Statements: Including both income statements and balance sheets, audited financial statements from the last three years are often requested to assess the financial health and operational transparency of an applying entity.

- Physician's Statement/Certification of Disability: For exemptions applicable to individuals with disabilities or specific health conditions, such as paraplegics or quadriplegics, a formal statement from a medical doctor certifying the condition and its permanence is required.

These documents collectively provide the South Carolina Department of Revenue with a comprehensive overview of the applicant's legal, financial, and operational status. Gathering this information is a critical step in the exemption application process, ensuring that all eligibility criteria are transparently and accurately met. This thorough vetting process helps maintain the integrity of the state's tax system while providing support to eligible individuals and organizations.

Similar forms

The South Carolina PT-401 form is closely related to the "Application for Residential Homestead Exemption," which many states offer to their residents. Both forms aim to reduce the tax burden on eligible property owners by exempting a portion of the property's value from taxation. In the case of the residential homestead exemption, this benefit typically applies to the primary residence of the homeowner and functions similarly to the PT-401 by requiring proof of eligibility, such as ownership documentation and personal identification.

Another document similar to the South Carolina PT-401 form is the “Vehicle Tax Exemption Form,” used by various states for individuals or organizations eligible for vehicle tax exemptions. Like the PT-401 form, which requires detailed information about vehicles eligible for tax exemption, this form also necessitates detailed vehicle descriptions, including make, model, year, and VIN, alongside specific eligibility criteria to qualify for the exemption.

The "Non-Profit Organization Tax Exemption Application" shares key similarities with the PT-401 form. Both documents are designed for entities seeking tax relief, necessitating detailed information about the organization, including its legal status, operational structure, and financial statements. Non-profits must provide evidence of their tax-exempt status, similar to how applicants of the PT-401 form are required to submit documents proving eligibility for the exemption.

The "Disabled Veteran Property Tax Exemption Form," found in many jurisdictions, parallels the PT-401 form in its purpose to offer tax relief to eligible veterans. Both require the applicant to provide official documentation affirming their status, such as a certification of disability in the case of disabled veterans. Additionally, these forms necessitate information regarding the property or vehicle for which the exemption is sought, underscoring the targeted nature of the tax relief they provide.

Lastly, the "Affordable Housing Property Tax Exemption Application" bears resemblance to the PT-401 form by targeting a specific group – affordable housing entities. Like the PT-401, applicants must furnish comprehensive details about the property, including usage and ownership status, and provide documents like deeds and financial statements. Both forms serve to promote social objectives through tax relief, in this case, making housing more affordable for low- and moderate-income residents.

Dos and Don'ts

When preparing the South Carolina PT 401 form, which is critical for obtaining property tax exemptions, certain practices should be upheld while others avoided to ensure a smooth and timely processing. Adhering to these can greatly impact the acceptance of your application.

Do:- Complete all required sections: Ensure every applicable part of the form is filled out. Omissions can lead to your application being returned.

- Print legibly: Illegible writing can cause misunderstandings, inaccuracies, or delays, so make sure all information is easy to read.

- Include all necessary documentation: Attach copies of deeds or titles, registration cards, bills of sale, and financial statements as per the item you are claiming an exemption for. Missing documents can result in processing delays.

- Specify the property type and provide the correct information: Accurately list whether the exemption is for real estate, vehicles, or other specific property types, including all required details such as vehicle identification numbers (VIN), tax map numbers, and deed book and page numbers.

- Provide detailed information for vehicles: When listing vehicles, ensure you supply the make, year, and VIN, and classify the vehicle correctly according to the types provided.

- Check applicable boxes for real estate exemptions: Make certain to mark the relevant boxes if applying for real estate exemptions to clearly indicate your request.

- Use additional sheets where necessary: For complex items like furniture and fixtures, attach separate sheets detailing acquisition date, cost, accumulated depreciation, and net value.

- Update your records accordingly: If applying for exemptions under categories that require informing the Department of Revenue about changes, such as a new address for a qualified surviving spouse, ensure this information is up to date.

- Leave sections incomplete: Failing to fill out all relevant parts of the form can result in it being returned to you, causing delays.

- Use nicknames or initials: Always provide full legal names and other official identifiers as required.

- Guess information: If you are unsure about certain details like the tax map number or the specific classification for a vehicle, consult with the appropriate county office or professional for accuracy.

- Overlook the specific requirements for exemptions: Each exemption category, such as for nonprofit housing or veteran-owned vehicles, has specific documentation requirements. Ensure you meet these before submitting.

- Assume one document fits all purposes: A VA Rating Decision letter, for example, does not substitute for a certificate proving 100% total and permanent service-connected disability in some cases.

- Submit without reviewing: Always check your application for completeness and accuracy before sending it to avoid simple mistakes that can lead to delays.

- Forget to sign and date: An unsigned or undated form is incomplete and will be returned.

- Send original documents: Provide copies of the necessary documents, not the originals, to avoid loss of important personal records.

Misconceptions

Understanding the South Carolina PT-401 form, commonly known as the Tax Exemption Application, is crucial for those seeking exemptions. However, several misconceptions exist about the form and its requirements. It's essential to clarify these to ensure applications are appropriately filed and processed without delay.

Only the property owner can file the PT-401 form. This is incorrect. An owner or an authorized agent can complete the form, as long as they provide all necessary information and documentation.

All property types automatically qualify for exemptions. Not all properties are eligible for exemptions under the PT-401 form. The property must meet specific criteria outlined in the SC Code Section 12-37-220 to qualify.

Filling out the form is enough to receive an exemption. Simply submitting the form does not guarantee exemption. It must be completely filled out, and all required documentation must be provided. Incomplete applications will be returned.

Vehicle exemptions are based solely on ownership. For vehicles to be exempt, they must meet the criteria listed under specific categories, such as ambulances, fire trucks, or vehicles owned by disabled veterans and designated for special license tags.

The PT-401 form covers federal tax exemptions. This form is for South Carolina state tax exemptions on properties and does not apply to federal taxes.

There is no need to list the tax map number or deed book and page number. These details are crucial for identifying the property correctly and must be obtained from the County Assessor to complete the application.

Nonprofit organizations automatically receive exemptions for all their properties. Nonprofit status does not automatically exempt all properties. Specific usage criteria must be met, and proper documentation, including the IRS Determination Letter and audited financial statements, must be provided.

Exemptions once granted are permanent. Exemption status can change if the property usage changes or no longer meets the eligibility criteria. Continuous compliance is necessary to maintain exemption status.

The form is only for real estate property. The PT-401 form applies to more than just real estate. It also covers vehicles, furniture, and fixtures under certain conditions.

The application process is long and complicated. While the application does require detailed information and documentation, understanding the instructions and preparing in advance can streamline the process. Assistance is available for those who need it.

Addressing these misconceptions is vital for a smooth application process. Applicants are encouraged to carefully read the instructions, gather all necessary information and documents before applying, and reach out for help if needed to ensure that the PT-401 form is correctly completed and submitted. Timeliness and accuracy in completing the application play significant roles in the consideration of exemption requests.

Key takeaways

When applying for a tax exemption in South Carolina using the PT-401 form, the following key points should be kept in mind:

- Every section of the PT-401 form designated as applicable must be filled out completely by the property owner or their authorized agent for the application to be considered. Incomplete applications will be returned, delaying the process.

- It is mandatory to include the legal owner’s details, such as name, address, social security number, or federal identification number on the form.

- For real property exemption requests, the date the real estate was acquired, alongside the tax map number, deed book, and page number must be clearly listed. This information can be obtained from your county assessor.

- The application must identify the vehicle by VIN (Vehicle Identification Number), not by the license tag number, and include details such as the make and year of the vehicle.

- Organizations applying for an exemption on furniture and fixtures should attach a separate sheet detailing item(s), date of acquisition, cost at acquisition, accumulated depreciation, and net value.

- Required documentation for filing includes copies of the deed or title to real property, vehicle registration card, bill of sale or title, IRS Determination Letter, Articles of Incorporation, Bylaws, and the past three years of audited financial statements among other relevant documents, depending on the exemption classification under SC Code Section 12-37-220.

- The form needs to be mailed to the South Carolina Department of Revenue, Property Division, with all requested information printed clearly.

- Special exemptions are available for different groups including disabled veterans, law enforcement officers, paraplegic or hemiplegic persons, and certain nonprofit organizations fulfilling specific criteria as outlined in the instructions.

The PT-401 form serves as a critical document for those seeking tax exemption for their properties or vehicles in South Carolina, emphasizing the need for attention to detail and completeness in its preparation.

More PDF Templates

South Carolina Retirement - The form provides a section for active members to choose beneficiaries for the Retirement Systems Group Life Insurance payout.

Sc 1040 Form 2023 Pdf - The South Carolina Form SC1040ES is a declaration of estimated tax for individuals, allowing taxpayers to make advance payments on expected tax liabilities for the year 2003.

South Carolina Sales Tax Form - Indicates where to sign and date the return, ensuring timely and accurate tax reporting.