Free South Carolina 1102 PDF Template

The South Carolina 1102 form serves a crucial role for active members within the state's retirement systems, guiding them through the beneficiary designation process. Revised on March 25, 2005, this document meticulously outlines the steps for members to designate primary and contingent beneficiaries for various benefits, including refunds of contributions and potential survivor benefits. The form, which necessitates completion in black ink, underscores the importance of consulting with an attorney or estate planner to ensure informed decisions. It accommodates designations for active members exclusively, directing retirees towards a different document, Form 7201. By meticulously detailing personal information and beneficiary particulars, this form stands as a comprehensive tool for managing post-retirement benefits distributions. The inclusion of sections for Group Life Insurance, without the option for contingent beneficiaries, further extends its utility. With emphases on certification, conditions, and the notarization requirement, the South Carolina 1102 form encapsulates a thorough approach to securing financial futures for members' beneficiaries, thereby safeguarding interests and ensuring peace of mind for all involved.

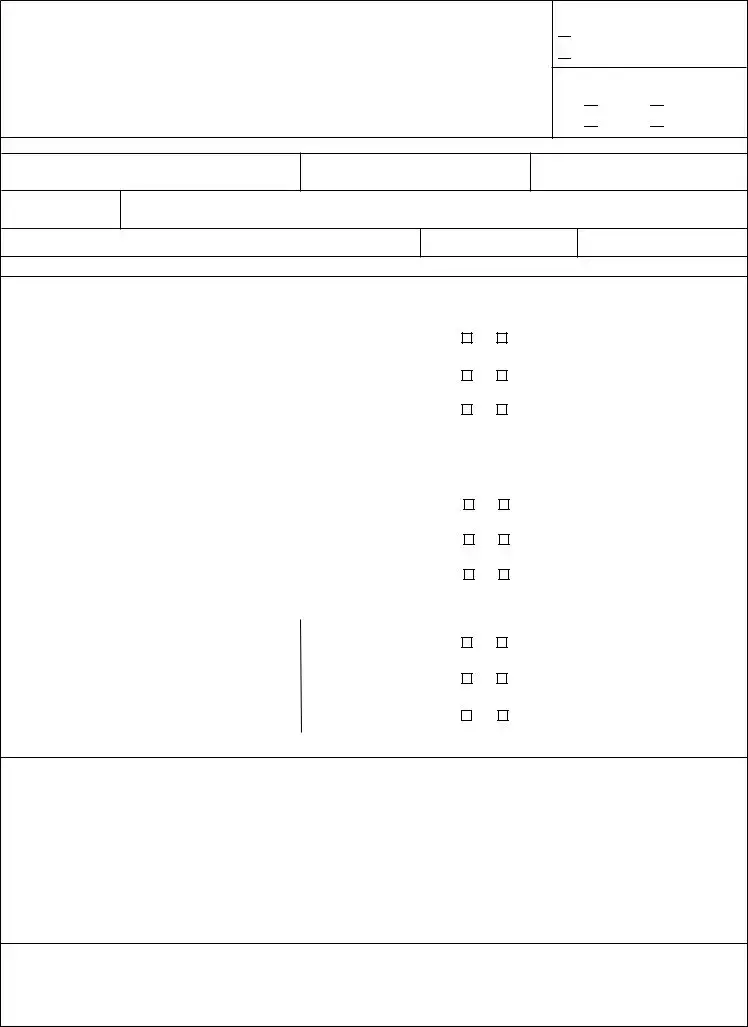

Document Preview

Form 1102

Revised 03/25/2005

Page 1

Print or type in black ink

Please read the instructions on the reverse (page 2) before completing this form.

ACTIVE MEMBER BENEFICIARY FORM

BENEFICIARY DESIGNATION, CONTINGENT BENEFICARY FOR ACTIVE MEMBERS ONLY- RETIREES USE FORM 7201

South Carolina Retirement Systems

State Budget and Control Board

Box 11960, Columbia, SC

Use for designation of active member beneficiaries and contingent beneficiaries. You may wish to consult with an attorney/estate planner before completing this form.

CHECK ONE:

New Enrollee

New Enrollee

Change of Beneficiary

Change of Beneficiary

Retirement System (check one)

SCRS

SCRS  PORS

PORS

GARS

GARS  JSRS

JSRS

Section I |

PERSONAL INFORMATION |

1. Last Name & Suffix

2. First/Middle Name

3. Social Security Number

4. Date of Birth

5. Address

6. City

7. State

8. ZIP+4

ALL SECTIONS MUST BE COMPLETED

Section |

BENEFICIARY(IES) FOR REFUND OF CONTRIBUTIONS/SURVIVOR BENEFITS - I designate the following |

|||||||||||||

|

|

|

PRIMARY beneficiary(ies) to receive the Retirement Systems refund of contributions or survivor benefits if eligible. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||||||

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent Beneficiaries Have No Rights Unless All Primary Beneficiaries Have Died - I designate the following CONTINGENT beneficiary(ies) to receive the

Section

beneficiaries will be revoked and your estate will become your contigent beneficiary.

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

|||||

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section III BENEFICIARY(IES) FOR GROUP LIFE INSURANCE (You may not designate contingent beneficiaries for Group Life) I designate the following beneficiary(ies) to receive the Retirement Systems Group Life Insurance:

1. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of Beneficiary (ONE PERSON) |

Social Security # |

Sex |

|

Date of Birth |

|

Relationship |

||||

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section IV |

CERTIFICATION AND CONDITIONS |

|

|

|

|

|

||||

IMPORTANT: Please read the Certification and Conditions sections of the instructions on the reverse (page 2) before signing this form. I hereby certify I have read and understand the information on the reverse (page 2), including the certification and conditions, and I agree to the provisions stated.

MEMBER'S SIGNATURE ______________________________________________ WITNESS _____________________________________________

(Do not print)(Required only when signed by mark)

STATE OF ___________________________________________________________ COUNTY OF __________________________________________

Acknowledged before me this date ________________________________ NOTARY NAME _______________________________________________

My Commission Expires ________________________________ NOTARY SIGNATURE __________________________________________________

(Out of state, requires Seal)

THE LANGUAGE USED IN THIS DOCUMENT DOES NOT CREATE ANY CONTRACTUAL RIGHTS OR ENTITLEMENTS AND DOES NOT CREATE A CONTRACT BETWEEN THE MEMBER AND THE SOUTH CAROLINA RETIREMENT SYSTEMS. THE SOUTH CAROLINA RETIREMENT SYSTEMS RESERVES THE RIGHT TO REVISE THE CONTENT OF THIS DOCUMENT.

PAGE ____ OF ____

Form 1102, Page 2 |

INSTRUCTIONS |

USE THIS FORM FOR ACTIVE MEMBER BENEFICIARY DESIGNATIONS WHICH DO NOT REQUIRE A TRUSTEE APPOINTMENT. THIS FORM MUST BE COMPLETED IN ITS ENTIRETY EACH TIME. AN ACKNOWLEDGMENT LETTER WILL BE SENT TO THE MEMBER EACH TIME A FORM IS RECEIVED BY THE SC RETIREMENT SYSTEMS. FOR RETIREE BENEFICIARY DESIGNATION, USE FORM 7201.

Check the appropriate boxes in the upper right corner. If you are a member of more than one system, complete a beneficiary form (FORM 1102) for each system. You should complete a form for each system of which you are a member when making any beneficiary changes (i.e. if you complete a FORM 1102 for your SCRS account, beneficiary changes will be for that system only, your prior designations for your PORS account would still be in effect).

SECTION I |

|

SECTION |

REFUND OF CONTRIBUTIONS/SURVIVOR BENEFITS |

On this form you may designate a person(s) or your estate as beneficiary for your retirement contributions or survivor benefits. Leave the relationship, sex, date of birth, and SSN blank if you are naming your estate as beneficiary. If you are naming your estate as beneficiary, you may not designate a person(s) for this portion of your retirement benefits. If additional space is needed to designate more than 3 beneficiaries, complete and attach a second FORM 1102 and indicate on the form how many pages are being submitted. That information will assist the SC Retirement Systems in determining total number of forms submitted in the event the forms are separated during the processing.

SECTION

In accordance with

SECTION III |

GROUP LIFE INSURANCE |

You may name different beneficiaries for the Group Life Insurance (a benefit equal to your annual salary), paid in a lump sum (if the employer has elected this coverage). The $3,000 State Life Insurance and Optional Life Insurance are administered by the Office of Insurance Services; contact the OIS for information pertaining to those benefits. Contact your employer or SC Retirement Systems for Group Life coverage. If you do not have Group Life Insurance, write "N/A" in Section III on the reverse (page 1) of this form.

SECTION IV |

CERTIFICATION AND CONDITIONS |

1.CERTIFICATION: This form must be signed by the member in the presence of a notary public and be properly notarized. If more than one form is completed, ALL forms must be notarized on the same date. FORMS ALTERED IN THE BENEFICIARY

DESIGNATION OR CERTIFICATION SECTIONS WILL NOT BE ACCEPTED.

2.REVOCATION: All previous beneficiary designations to receive retirement benefits are hereby revoked.

3.AUTHORIZATION: I hereby authorize the SC Retirement Systems to make payment of any refund of my accumulated contributions and/or any other payment due in the event of my death prior to retirement to the beneficiary(ies) designated on the front of this form (page 1) in accordance with the provisions of the SC Retirement Systems , and agree on behalf of myself and my heirs and assigns, that any payment so made shall be a complete discharge of the claim or claims, and shall constitute a release of the Retirement Systems from any further obligations on account of the benefit or benefits. In the event my primary beneficiary(ies) predeceases me and if a contingent beneficiary designation is on file, the SC Retirement Systems would pay any benefits due to the contingent beneficiary(ies). In the event that no primary beneficiary(ies) or contingent beneficiary(ies) are alive at the time of my death, my estate (which is ineligible for survivor benefits), will automatically become my designated beneficiary. I reserve the right to change the designated beneficiary(ies) by a written designation filed with the SC Retirement Systems in accordance with its rules and regulations.

4.PAYMENT: The SC Retirement Systems shall be fully discharged of liability for all amounts paid to the beneficiary(ies), and shall have no other obligation as to the application of such amounts. In any dealing with a beneficiary(ies), including but not limited to any consent, release, or waiver of interest, the SC Retirement Systems shall be fully protected against the claim or claims of every other person.

5.MULTIPLE BENEFICIARIES: Survivor benefits payable to 2 or more beneficiaries shall be calculated based upon the average age of the designated beneficiaries. Payments will be equally divided among surviving beneficiaries at the member's death.

Please call SC Retirement Systems Customer Service with any questions: (800)

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | Form 1102 is used by active members of the South Carolina Retirement Systems to designate beneficiaries and contingent beneficiaries for refund of contributions/survivor benefits and Group Life Insurance benefits. |

| Eligibility | This form is specifically for active members only; retirees are directed to use Form 7201 for their beneficiary designations. |

| Section Requirements | All sections of the form must be completed for the beneficiary designation to be valid, including personal information and details about the beneficiary(ies). |

| Contingent Beneficiaries | Active members can name contingent beneficiaries to receive benefits in the event that all primary beneficiaries have died, except for Group Life Insurance, which does not allow contingent beneficiaries. |

| Legal Framework | The form operates under specific South Carolina laws, including sections §9-1-1650, §9-9-100, and §9-11-110 of the Code of Laws of South Carolina (1976), as amended. |

| Notarization and Certification | A member's signature must be notarized to certify the form. The form also stipulates that previous beneficiary designations are revoked upon submission of a new form, emphasizing the importance of the form's accuracy and completeness. |

Guidelines on Filling in South Carolina 1102

Filling out the South Carolina Form 1102 is an essential step for active members of the retirement system in designating or changing beneficiaries for their retirement benefits. This form allows for the specification of both primary and contingent beneficiaries to ensure that retirement contributions, survivor benefits, and group life insurance proceeds are distributed according to the member's wishes. Given the implications of these designations on one's estate and loved ones, it may be advisable to consult with a legal professional or estate planner before completing this form.

- Check the appropriate box at the top of the form to indicate whether you are a new enrollee or making a change of beneficiary.

- Select your retirement system by checking the corresponding box for SCRS, PORS, GARS, or JSRS.

- In Section I, provide your personal information including last name, first and middle names, Social Security Number, date of birth, and your complete address.

- In Section II-A, designate your primary beneficiary(ies) for the refund of contributions/survivor benefits:

- Enter the name, Social Security Number, sex, date of birth, and relationship for up to three beneficiaries.

- In Section II-B, designate your contingent beneficiary(ies):

- Enter the name, Social Security Number, sex, date of birth, and relationship for up to three contingent beneficiaries.

- For Group Life Insurance beneficiaries in Section III:

- Designate up to three beneficiaries for Group Life Insurance benefits, including their name, Social Security Number, sex, date of birth, and relationship. If you do not have Group Life Insurance, write "N/A".

- In Section IV, read the Certification and Conditions carefully. By signing the form, you acknowledge that you understand and agree to these terms.

- Sign and date the form in the presence of a witness. The witness must also sign the form. If the signature is a mark, a witness is required.

- Have the form notarized, including the state and county of acknowledgment, notary name, commission expiration date, and notary signature with a seal if out of state.

- Review the form to ensure all information is complete and accurate.

- Send the form to the address provided: South Carolina Retirement Systems, State Budget and Control easilyBoard, Box 11960, Columbia, SC 29211-1960.

Upon receipt, the South Carolina Retirement Systems will process your beneficiary designation. You will receive an acknowledgment letter once the designation has been recorded. It's important to keep a copy of the completed form for your records and notify the Retirement Systems of any future changes to your beneficiary designations.

Common Questions

What is the purpose of the South Carolina 1102 form?

The South Carolina 1102 form is used for active members of the South Carolina Retirement Systems to designate or change their primary and contingent beneficiaries for refund of contributions, survivor benefits, and Group Life Insurance benefits. It is essential for ensuring that the benefits go to the intended individuals or estate in the event of the member's death.

Who should complete the South Carolina 1102 form?

Active members of the South Carolina Retirement Systems, including SCRS (South Carolina Retirement System), PORS (Police Officers Retirement System), GARS (General Assembly Retirement System), and JSRS (Judicial System Retirement System), should complete the form. Retirees must use Form 7201 instead.

Can I designate anyone as a beneficiary on this form?

Yes, active members can designate individuals, trusts, or their estate as beneficiaries. However, for Group Life Insurance, contingent beneficiaries cannot be designated, and survivor benefits cannot be paid to an estate—only a lump sum refund.

What information is needed to complete the form?

Members must provide personal information, including name, Social Security Number, date of birth, and address. For each beneficiary, the member must include their name, Social Security Number, relationship to the member, sex, and date of birth. All sections of the form must be completed for it to be valid.

How do I change previously designated beneficiaries?

To change beneficiaries, you must complete a new Form 1102, indicating it's a change of beneficiary, and submit it according to the instructions. This new designation will revoke all previous beneficiary designations.

What if I don't want a contingent beneficiary?

If you do not wish to name a contingent beneficiary, you should write "NONE" in the appropriate section on the form. If the contingent beneficiary section is left blank, it defaults to your estate, revoking previous contingent beneficiaries if any.

What happens to the form after it's completed?

Once completed and properly notarized, the form should be sent to the South Carolina Retirement Systems at the address provided. An acknowledgment letter will be sent to the member once the form is received and processed.

Can I appoint more than one primary beneficiary?

Yes, you can designate more than one primary beneficiary for the refund of contributions or survivor benefits. If multiple beneficiaries are named, any survivor benefits payable will be divided equally among them based on the average age of all designated beneficiaries.

Is a witness or notary required when signing the form?

Yes, the form must be signed by the member in the presence of a notary public to be valid. The notary must also sign the form and provide their commission details. If the member signs by mark, a witness's signature is required.

Are there any special considerations for designating an estate as a beneficiary?

Yes, if designating your estate as the beneficiary for refund of contributions or survivor benefits, certain restrictions apply. Survivor benefits will not be paid to an estate, only a lump sum refund. Additionally, you may not designate a person(s) for this portion of your retirement benefits if your estate is named.

Common mistakes

When filling out the South Carolina 1102 form, people often make several mistakes that can complicate the process of designating beneficiaries for their retirement and life insurance benefits. It's important to be cautious and thorough to ensure your wishes are correctly documented. Here are six common errors:

-

Not using black ink: The instructions specify that the form should be filled out in black ink, yet this requirement is frequently overlooked. Forms filled out in other ink colors may not be processed correctly.

-

Omitting personal information: All sections, especially Section I which collects personal information, must be completed. Missing details can lead to delays or the form being returned.

-

Incomplete beneficiary information: It's crucial to fill out complete information for each beneficiary, including their relationship to you, their date of birth, and Social Security number. Skipping these details can render your designations invalid.

-

Failing to designate contingent beneficiaries: Many people forget to name contingent beneficiaries in Section II-B or write "NONE" when they, in fact, intend to have a backup. If the primary beneficiaries predecease you and no contingent beneficiaries are named, the benefits could default to your estate, which may not align with your wishes.

-

Not updating Group Life Insurance beneficiary designations: If you have Group Life Insurance, make sure the designated beneficiaries in Section III match your current wishes. People often overlook this, leaving outdated designations in place.

-

Improper notarization: The form must be signed in the presence of a notary and properly notarized. Mistakes in notarization, such as missing the notary’s signature or seal, especially for out-of-state notaries, can invalidate your designations.

Here are some additional tips to avoid other common issues:

Always check the correct boxes at the top of the form to indicate whether you're a new enrollee or making a change of beneficiary.

Ensure all forms are notarized on the same date if submitting multiple forms for different systems.

Review the Certification and Conditions section on the reverse page before signing to make sure you understand the terms of your designations.

By avoiding these pitfalls, you can help ensure your retirement system benefits will be distributed according to your wishes.

Documents used along the form

When filling out the South Carolina 1102 form for beneficiary designation, several documents often complement this process to ensure comprehensive estate and retirement planning. Understanding these documents can provide clarity and security for both the individual and their beneficiaries.

- Form 7201: Used by retirees to designate their beneficiaries, contrasting with Form 1102 designed for active members only. This ensures that retirees have a clear path to designate who should receive their benefits upon their death.

- Will: A legal document outlining the distribution of assets and care of dependents upon death. Although it covers more than just retirement funds, it's crucial for comprehensive estate planning alongside Form 1102.

- Trust Documents: These specify how assets are to be handled and distributed by a third party. Trusts can provide more control over the distribution of assets, including those not covered by Form 1102.

- Power of Attorney (POA): Authorizes another person to make decisions on one's behalf. A POA can be indispensable in managing retirement accounts if the individual becomes unable to do so.

- Living Will: Outlines an individual's wishes regarding medical treatments in scenarios where they can no longer express informed consent. It’s important for comprehensive planning but doesn't affect Form 1102 directly.

- Marriage Certificate or Divorce Decree: Legal documents proving current marital status. These can be crucial in beneficiary disputes or when designating a spouse as a beneficiary.

- Birth Certificates of Dependents: Required for verifying dependents, especially if designating minor children as beneficiaries or contingent beneficiaries on Form 1102.

- Death Certificate: In situations involving changes due to the death of a previously designated beneficiary, a death certificate may be necessary to process the change.

In conclusion, while Form 1102 is a key document for South Carolina Retirement System members, it doesn't exist in isolation. Proper estate and retirement planning involves a suite of documents, each playing a critical role in securing an individual's financial legacy and ensuring their wishes are honored. It is advisable to consult with a legal expert or estate planner when preparing these documents to ensure all aspects of one's estate are covered comprehensively.

Similar forms

The South Carolina 1102 form shares similarities with a Last Will and Testament, primarily in its function to designate beneficiaries for the distribution of assets upon the member's death. Both documents allow individuals to specify who will receive their assets, whether in the form of retirement contributions, group life insurance, or personal property, ensuring that their wishes are respected and followed after their passing. However, unlike a will, the 1102 form is specifically tailored for members of the South Carolina Retirement Systems, focusing on retirement and insurance benefits rather than a broader scope of personal assets.

Comparable to a Trust Instrument, the 1102 form permits the designation of contingent beneficiaries, acting as a safety net should the primary beneficiaries predecease the member. This feature is akin to a trust’s mechanism to handle the distribution of assets if primary beneficiaries are unable to inherit. Both instruments allow for structured planning regarding the eventual disposition of assets, providing a clear directive to the managing entity (trustee or the retirement system) on distributing those assets in the absence of the primary beneficiaries.

Similar to a Life Insurance Policy, the 1102 form involves naming beneficiaries for group life insurance benefits, exclusive to the scope of the South Carolina Retirement Systems. Both the form and life insurance policies serve to provide financial security to chosen individuals upon the policyholder's or member's death. In each case, the designated beneficiaries are entitled to receive specified benefits, which are paid out as lump sums, alleviating financial burdens during difficult times.

The 1102 form somewhat mirrors a Power of Attorney (POA), specifically a Non-Durable POA for Finances, in that it allows members to make decisions affecting the future handling of their financial assets. While the POA grants an agent authority to manage an individual’s financial affairs actively, the 1102 form enables members to control the posthumous distribution of their retirement and group life insurance benefits, indirectly influencing their financial legacy.

Pension Beneficiary Designation forms, which are utilized across various retirement systems and plans, bear a striking resemblance to the 1102 form. Both serve the central purpose of designating beneficiaries for retirement benefits and life insurance, ensuring members can specify recipients for their financial benefits upon their death. These forms are crucial tools for financial and estate planning within the context of retirement planning, addressing the need for clear directives on the distribution of pension and insurance proceeds.

Revocable Living Trust documents and the 1102 form share the concept of amending beneficiary designations, offering flexibility throughout the member's life. Just as a living trust can be altered as circumstances change, the 1102 form permits updates to beneficiary designations, allowing members to adjust their choices in response to life events, such as marriages, divorces, births, or deaths, ensuring their intent is accurately reflected over time.

The 1102 form is paralleled by Employee Benefit Plan Designation forms found in private sector retirement plans. Both types of forms are essential for specifying beneficiaries for retirement benefits, albeit in different contexts. While private sector forms may encompass a broader range of benefits and plans, the 1102 form is focused on state-run retirement system members, both aiming to ensure that benefits are distributed according to the member's wishes, securing a financial future for their chosen beneficiaries.

Beneficiary Deeds, used to transfer real property upon death, and the 1102 form share the fundamental purpose of bypassing probate by directly designating beneficiaries. While the beneficiary deed concerns real estate, the 1102 form pertains to retirement and insurance benefits. Each serves to simplify the transfer process of significant assets, ensuring they pass directly to the intended recipients without the need for probate court intervention, thus avoiding potential legal complications and delays.

Finally, the 1102 form has similarities with the Transfer on Death (TOD) Registration agreements used for brokerage and investment accounts. Both mechanisms allow for the direct transfer of assets to designated beneficiaries upon the account holder's or member’s death, bypassing the probate process. This ensures that the assets, whether financial accounts or retirement system benefits, are promptly transferred to beneficiaries, reflecting the individual's wishes without unnecessary delay or legal hurdles.

Dos and Don'ts

When filling out the South Carolina 1102 form, it's essential to follow the correct procedures to ensure your beneficiary designations are valid and accurately reflect your wishes. Here are eight do's and don'ts to guide you through the process:

- Do print or type in black ink to ensure the information is legible and can be processed correctly.

- Do carefully read the instructions provided on the reverse side of the form before you start filling it out, as this will help you understand the requirements and avoid common mistakes.

- Do complete all sections in their entirety. Missing information may result in processing delays or the form being considered invalid.

- Do consider consulting with an attorney or estate planner before completing the form, especially if your estate is complex or you have specific wishes regarding your benefits.

- Don't leave the contingent beneficiary section blank unless you intend for your estate to be your contingent beneficiary, as this will happen by default if no contingent beneficiary is named.

- Don't forget to sign the form in the presence of a notary public and ensure it is properly notarized. Unsigned or improperly notarized forms will not be accepted.

- Don't alter the form in the beneficiary designation or certification sections after it has been completed, as altered forms will not be processed.

- Don't hesitate to contact SC Retirement Systems Customer Service for assistance if you have questions or need clarification on how to properly complete the form.

By following these guidelines, you can help ensure your beneficiary designations are properly recorded and will be carried out according to your wishes. Remember, the choices you make on this form are important and can have lasting impacts on your beneficiaries.

Misconceptions

Many believe that the South Carolina 1102 form can be used by retirees for beneficiary designations, but this is incorrect. The form clearly states it is for active members only, and retirees are directed to use Form 7201 instead.

There is a misconception that contingent beneficiaries have rights to benefits as soon as they are named on the Form 1102. In reality, contingent beneficiaries have no rights unless all primary beneficiaries have died, as explicitly mentioned in the form's instructions.

Some think that if they leave the contingent beneficiary section blank, their previous designations remain effective. However, failing to designate a contingent beneficiary by leaving the section blank automatically revokes any previous designations, defaulting to the estate as the contingent beneficiary.

It's often misunderstood that group life insurance can include contingent beneficiaries. The form specifies that you cannot designate contingent beneficiaries for Group Life Insurance, contrasting with the provision for other benefits.

A common error is assuming that if multiple 1102 forms are submitted, only the most recent needs to be notarized. Every form submitted must be signed in the presence of a notary public and properly notarized, safeguarding the process's integrity.

Some believe that designating a beneficiary for their retirement or survivor benefits on this form restricts the Retirement Systems’ ability to make changes. The language on the document clarifies that it does not create any contractual rights or entitlements, nor does it create a contract between the member and the South Carolina Retirement Systems.

There's a notion that filling out this form once covers all retirement systems a member might be part of. According to the instructions, a separate Form 1102 must be completed for each retirement system the member wishes to designate beneficiaries for, highlighting the need for careful attention to each system's requirements.

Finally, many are under the impression that the SC Retirement Systems requires a trustee appointment for beneficiary designations. The Form 1102 instructions clearly state it is for active member beneficiary designations which do not require a trustee appointment, simplifying the process for members.

Key takeaways

Filling out the South Carolina 1102 form correctly is crucial for active members of the South Carolina Retirement Systems. Here are nine key takeaways to ensure the form is filled out and used effectively:

- Ensure all personal information is filled out in Section I, including name, Social Security Number, and address, using black ink to aid in the document's clarity.

- The form enables the designation of primary beneficiaries for refunds of contributions or survivor benefits under Section II-A. Active members can specify who they would like their benefits to go to in the event of their death.

- Contingent beneficiaries, who will only receive benefits if all primary beneficiaries have died, can be designated under Section II-B. This highlights the importance of keeping beneficiary designations updated to reflect current wishes.

- Group Life Insurance beneficiaries are designated in Section III, but it's important to note that contingent beneficiaries cannot be designated for this benefit.

- Review and update the form as needed to reflect changes in beneficiary information or personal circumstances. Changes in marital status, the birth of children, or the death of a beneficiary might necessitate an update to the form.

- Forms must be signed and notarized in Section IV to validate the member's beneficiary designation, with the explicit understanding that previous designations are revoked upon the submission of a new form.

- If using this form for the first time or making changes, check the appropriate box at the top of the form to indicate whether this is a new enrollment or a change of beneficiary.

- The form explicitly states that survivor benefits will not be paid to an estate, with the exception of lump-sum refunds, underscoring the importance of designating individual beneficiaries.

- Members are encouraged to consult with an attorney or estate planner before completing the form, indicating the legal and financial significance of the beneficiary designations.

Remember, the South Carolina 1102 form is an important document for managing how benefits are handled and distributed in the event of a member's death. Keeping this form up-to-date ensures that a member's wishes are carried out as intended, making it a key component of estate planning for members of the South Carolina Retirement Systems.

More PDF Templates

Sc Real Estate Law - The contract sets forth terms regarding appraised value, offering flexibility and options should the property not meet the agreed valuation, facilitating negotiations or contract termination.

South Carolina Sales Tax Form - Clarifies the state's sales tax holiday exemptions and other deductible sales types.

How to Become a Cna in South Carolina - Applications will be reviewed by DHSR within 10 business days from the date of receipt.