Free South Carolina 1040Es PDF Template

The South Carolina Department of Revenue provides essential instructions and forms for individuals required to file a declaration of estimated tax through the SC1040ES form. This requirement applies particularly to individuals expecting to owe $1000 or more in taxes for the year 2003. With specific filing dates and provisions for various taxpayers, including residents, non-residents, part-year residents, and those with income from farming or commercial fishing, the SC1040ES form is a critical document for ensuring tax compliance within the state. Taxpayers must adhere to the prescribed filing deadlines, which are primarily structured on a quarterly basis, to avoid penalties. Payment of estimated taxes can be made in equal amounts by the specified due dates or in full with the first installment, offering flexibility based on individual circumstances. Additionally, special considerations are given for joint filings, with guidelines on how spouses may file jointly or separately. The form also details instructions for amending declarations if an individual's tax situation changes significantly during the tax year, alongside outlining penalties for failing to file or pay estimated taxes as required. Moreover, methods to correctly use the payment-voucher and the significance of maintaining accurate records of estimated tax payments are stressed, underlining the SC Department of Revenue’s efforts to streamline the tax payment process while emphasizing taxpayer responsibility. The procedural guidance and structured format of the SC1040ES form underscore the state’s proactive stance on tax collection and taxpayer education.

Document Preview

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE www.sctax.org

INSTRUCTIONS AND FORMS FOR

2003

DECLARATION OF ESTIMATED TAX

FOR INDIVIDUALS

File and Pay

FORM SC1040ES

STATE OF SOUTH CAROLINA

INDIVIDUAL DECLARATION OF ESTIMATED TAX

INSTRUCTION AND WORKSHEET

The enclosed declaration

A WHO MUST FILE A DECLARATION

Every individual must file a declaration of estimated tax for 2003 if the expected total amount of tax owed when the income tax return is filed will be $1000.00 or more. This includes all individuals residing in the state, also nonresidents and

Exceptions for filing a declaration are:

(1)Farmers and Commercial Fishermen whose gross income from farming or fishing for 2002 or 2003 is at least

(2)Any Individual who was a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(3)Any Individual who was not a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(4)Any nonresident taxpayer doing business in South Carolina on a contract basis when the contract exceeds ten thousand dollars ($10,000) and the tax is withheld at the rate of two percent (2%) from each contract payment.

NOTE: You may be able to avoid making estimated tax payments by asking your employer to withhold more state tax from your earnings, if applicable. To increase your state withholding, file a new withholding exemption certificate. Civil service retirees may contact the US Office of Personnel Management at

B WHEN TO FILE YOUR ESTIMATED TAX

(2) Fiscal Year taxpayers must file their declaration of estimated tax vouchers on the 15th day of the 4th, 6th, and 9th months of the fiscal year and the first month of the following fiscal year.

C PAYMENT OF ESTIMATED TAX

Pay your estimated tax in equal amounts on the required filing dates attached to the corresponding voucher; however, you may pay all of your estimated tax on April 15, when the first installment is due. Instead of making your last payment of estimated tax on January 15 (Voucher Number 4), you may file your completed income tax return by January 31 and pay in full the balance of all income tax owed. If there is any overpayment shown on the income tax return filed, the overpayment may be transferred to your estimated tax account for the next year. The amount to be transferred must be entered on the income tax return. The declaration voucher does not have to be attached to the return for the transfer to be made.

D JOINT VS. SINGLE DECLARATION

A husband and wife who are living together may file a joint declaration; however, there are exceptions that require a single or separate declaration. These exceptions are: (1) married taxpayers with different taxable years and (2) married taxpayers who wish to retain their own identity by using different last names.

NOTE: Married taxpayers who file joint SC1040ES vouchers but file separately (or vice versa) when filing Form SC1040 may not receive proper credit for their estimated payments thus generating a deficiency or other notice. Should this occur, contact with the South Carolina Department of Revenue will be required to clarify the matter.

E AMENDED DECLARATION

Your declaration must be amended if you find that the estimated tax is substantially increased or decreased as a result of (1) a change in income, (2) a change in exemptions or (3) a change in the income tax withholding. The amended declaration should be filed on or before the next filing date that is June 16, September 15, or January 15. A special form for amending your declaration will not be needed. Therefore you must use the regular declaration voucher for the filing period.

F PENALTY FOR FAILURE TO FILE AND PAY ESTIMATED TAX

You may be charged a penalty for not paying enough estimated tax, or for not making the payments on time in the required amount. The penalty does not apply if each required payment is timely and the total tax paid is at least 90% of the total tax due. No penalty will be due for underpayments attributable to personal service income earned in another state on which income tax withholding due to the other state was withheld. Most taxpayers filing a declaration may also avoid penalty by paying 100% of the tax shown to be due on the return filed for the preceding taxable year. You must have filed a South Carolina return for the preceding tax year and it must have been for a full

G HOW TO USE THE

The preprinted

(1)If you do not have a preprinted

(2)Enter the amount shown on line 11 of the worksheet on the Amount of Payment line. If no payment amount is due, no payment voucher needs to be filed.

(3)Tear off at the perforation.

(4)Attach your check or money order, made payable to the South Carolina Department of Revenue, to the

Mail the

Cut Here

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

1 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

ENTER PAYMENT AMOUNT |

|

|

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

INSTRUCTIONS TO FOLLOW WHEN AMENDING YOUR DECLARATION

1.Use the Estimated Tax Worksheet on the reverse side as your guide to determine the Amended tax due using the corrected amounts of income, deductions and exemptions from your federal information.

2.Fill out the Amended Declaration Schedule below to determine the amount to be paid.

3.Refer to the

4.Tear off

|

2003 AMENDED DECLARATION SCHEDULE |

||

|

(Use if the estimated tax changes after you file your declaration.) |

||

|

|

|

|

1. |

Amended estimated tax enter here |

|

|

2. |

Less (A) Amount of 2002 overpayment elected for credit to 2003 |

|

|

|

(B) Estimated tax payments to date |

|

|

|

(C) Total of lines 2(A) and (B) |

|

|

3. |

. . . . . . . . . . . .Unpaid balance (subtract line 2(C) from line 1) |

|

|

4. |

Amount to be paid (line 3 divided by number of remaining filing dates) Enter here and on |

|

|

|

Payment |

|

|

|

|

|

|

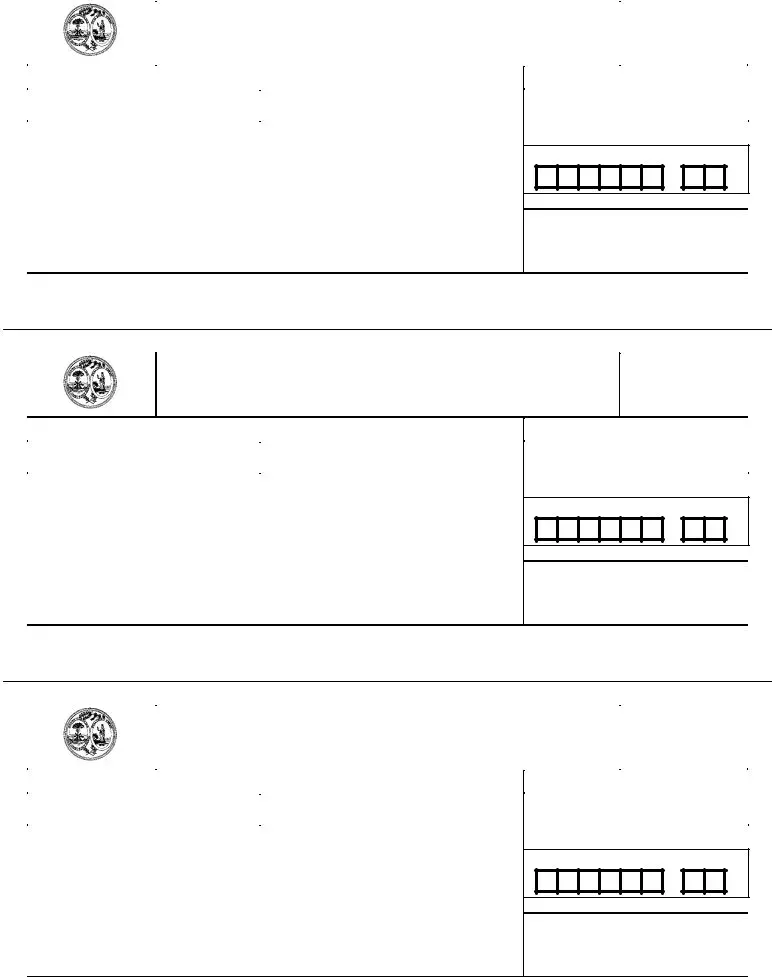

2003 Tax Computation Schedule for South Carolina Residents and Nonresidents

TAX COMPUTATION SCHEDULE |

|

|

|

Example of computation for Tax Computation Schedule |

||

|

|

|

|

|

||

If the amount on line 3 of worksheet is: |

Compute the tax as follows: |

|

|

South Carolina income subject to tax on line 3 of worksheet is $15,240. |

||

|

|

|

|

|

||

|

BUT NOT |

|

|

|

The tax is calculated as follows: |

|

|

|

|

|

|

|

|

OVER |

|

|

$15,240.00 income from line 3, of worksheet |

|||

$0 |

$2,460 |

2.5% Times the amount $ |

0 |

|

||

|

X .07 percent from tax computation schedule |

|||||

2,460 |

4,920 |

3% Times the amount less $ |

12 |

|

||

|

1,066.80 |

|

||||

4,920 |

7,380 |

4% Times the amount less $ |

62 |

|

||

|

||||||

7,380 |

9,840 |

5% Times the amount less $ 135 |

|

|||

|

|

|

||||

|

$ 709.08 rounded to $710.00 |

|||||

9,840 |

12,300 |

6% Times the amount less $ 234 |

|

|||

|

|

|

||||

12,300+ |

or more |

7% Times the amount less $ 357 |

|

$710.00 is the amount of tax to be entered on line 4 of worksheet |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 2 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

3 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

||

|

|

|||

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

|

|

|

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 4 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

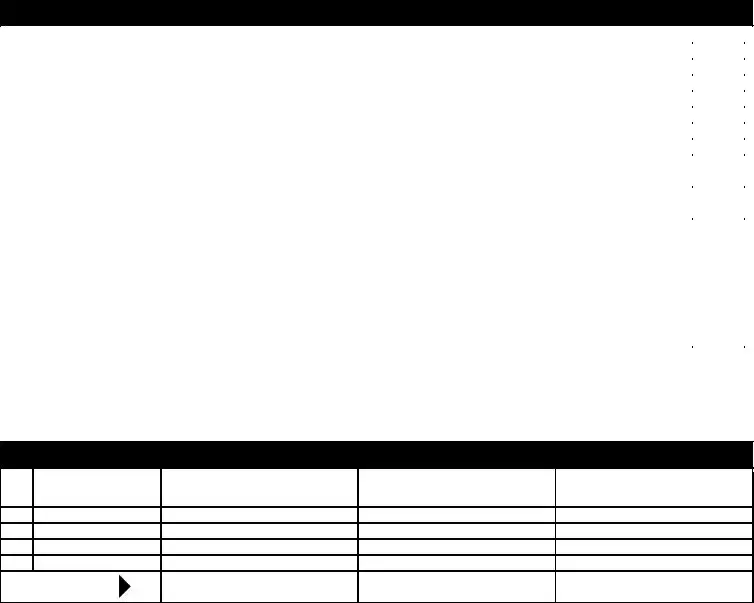

WORKSHEET AND RECORD

OF ESTIMATED TAX PAYMENT

HOW TO COMPUTE YOUR ESTIMATED TAX (Nonresident - see special instructions below.)

Below is your Estimated Tax Worksheet with the tax computation schedule for computing estimated tax. Use your 2002 income tax return as a guide for figuring the estimated tax. See instruction F for penalties.

2003 ESTIMATED TAX WORKSHEET

1. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter amount of your federal taxable income from the 2003 Federal 1040ES, line 5 |

1. |

$ |

|

|

||

|

|

||||||

2. |

Allowable State Adjustments (plus or minus) . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2. |

$ |

|

|

|

|

|

|

|||||

3. |

This is your South Carolina taxable income . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3. |

$ |

|

|

|

|

|

|

|||||

4. |

Tax (Figure the tax on line 3 by using the Tax Computation Schedule in these instructions.) |

4. |

$ |

|

|

||

|

|

||||||

5. |

Enter any additional tax (SC4972) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

5. |

$ |

|

|

|

|

|

|

|

||||

6. |

Add lines 4 and 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

6. |

$ |

|

|

|

|

|

|

|

||||

7. |

Credits (Child and Dependent Care credit, Tax credit to other states, Two Wage Earner credit, Water Resources, etc) . . . . |

7. |

$ |

|

|

||

|

|

||||||

8. |

Subtract line 7 from line 6 |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

8. |

$ |

|

|

|

|

|

|

||||

9. |

State income tax withheld and estimated to be withheld (including income tax withholding on pension, annuities, etc.) |

|

|

|

|

||

|

during the entire year 2003 |

9. |

$ |

|

|

||

|

|

|

|||||

10. |

Balance estimated Tax (Subtract line 9 from line 8.) If $1000.00 or more, complete and file the |

|

|

|

|||

|

your payment; if less, no payment is required at this time |

10. |

$ |

|

|

||

|

|

|

|||||

|

Caution: You are required to prepay at least 90% of your tax liability each year. If you prepay less than 90% of your |

|

|

|

|

||

|

actual tax liability, you may be subject to a penalty. See Section F of the instructions for penalty information. |

|

|

|

|

||

|

If you are unsure of your estimate, you may want to pay more than 90% of the amount you have estimated. |

|

|

|

|

||

11. |

If the first payment you are required to file is: |

|

|

|

|

|

|

|

Due April 15, 2003, enter 1/4 |

} |

of line 10 (less any 2002 |

|

|

|

|

|

Due June 16, 2003, enter 1/2 |

overpayment applied to 2003 |

|

|

|

|

|

|

Due September 15, 2003,enter 3/4 |

estimated tax). Enter here and |

|

|

|

|

|

|

Due January 15, 2004,enter amount |

on your |

11. $ |

|

|

||

|

|

|

|||||

|

|

|

|

|

|

|

|

RECORD OF ESTIMATED TAX PAYMENT

|

|

|

(C) 2002 |

(D) TOTAL PAID |

NO. |

(A) DATE |

(B) AMOUNT |

OVERPAYMENT |

AND CREDITED |

|

|

|

CREDIT APPLIED |

ADD (B) and (C) |

1.

2.

3.

4.

TOTAL . . . . . . . .

NONRESIDENT - SPECIAL INSTRUCTIONS

Use the 2002 Form SC1040 and Schedule NR as a basis for determining the modified South Carolina taxable income subject to an estimated tax. Enter the modified South Carolina taxable income on line 3 of the above worksheet. Determine the amount of tax using the 2003 tax computation schedule. Enter the tax on line 4 of above worksheet. Complete lines 5 through 11 of above worksheet as instructed.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SC1040ES form is used for filing an individual's estimated taxes in South Carolina. |

| Who Must File | Individuals expecting to owe $1000.00 or more in taxes when their income tax return is filed. |

| General Filing Dates | April 15, June 16, September 15 of the current year, and January 15 of the following year. |

| Exceptions for Filing | Farmers and Commercial Fishermen, residents with no prior year's South Carolina tax liability, and nonresidents under certain conditions. |

| Payment Methods | Payments can be made online or via mailed payment voucher attached to a check or money order. |

| Joint vs Single Declaration | Joint declaration is available for married taxpayers living together, with exceptions requiring separate declarations. |

| Amended Declaration | Amendments should be made if the estimated tax significantly changes due to income, exemptions, or withholding variations. |

| Penalties | Penalties may be applied for underpayment or late payment unless exceptions are met. |

| How to Use the Payment Voucher | The payment voucher must include the taxpayer's details and the amount of payment, attached to the payment mailed to the specified address. |

Guidelines on Filling in South Carolina 1040Es

Filing the South Carolina 1040ES form is an essential step for individuals who anticipate owing $1,000 or more in taxes for the year. This process involves estimating your income tax and making payments throughout the year, if necessary, to avoid any penalties. Below, you will find a step-by-step guide to help you through the preparation and filing of this form. It is designed to ensure that your estimated tax payments are both timely and accurate, providing you with peace of mind as you navigate through tax season.

- Begin by gathering your previous year's income tax return. This document will serve as a helpful guide for estimating your current year's income and deductions.

- Access and download the 2003 Declaration of Estimated Tax (Form SC1040ES) from the South Carolina Department of Revenue website at www.sctax.org.

- Review the eligibility criteria under the "Who Must File a Declaration" section to confirm that you are required to file this form based on your tax situation.

- Identify the correct filing period for your estimated taxes. Take note of the specific due dates for each payment: April 15, June 16, September 15, and January 15 of the following year.

- Use the Estimated Tax Worksheet provided on the form to calculate your estimated tax for the year. This involves determining your expected federal taxable income, making any necessary adjustments for South Carolina, and using the Tax Computation Schedule to calculate your tax.

- If applicable, decide whether you will make your estimated tax payments in equal amounts on the due dates or opt to pay all your estimated tax by April 15.

- Fill out the declaration voucher portion accurately, making sure to check the preprinted information for any errors. If there are mistakes, clearly type or print your corrections.

- Write a check or obtain a money order for the amount of your estimated tax payment, making it payable to the South Carolina Department of Revenue.

- Tear off the payment voucher at the perforation and attach your payment to it. Mail your payment along with the voucher to the address provided: South Carolina Department of Revenue, Estimated Tax, Columbia, SC 29214-0005. Be sure to use the preaddressed label if one was provided.

- Finally, remember to fill in the Record of Estimated Tax Payments on page 2 of the form. This is crucial for keeping track of all payments you've made during the year, as the Department of Revenue will not send you a statement of your estimated tax payments.

After submitting your estimated tax payment for the initial quarter, repeat the process for any remaining payments as their respective due dates approach. Adjust your estimated payments if necessary, especially if there are significant changes to your income, deductions, or tax credits throughout the year. Amending your declaration, if needed, can help prevent underpayment penalties. Remaining diligent and proactive in managing and updating your estimated tax payments is pivotal to a smooth and penalty-free tax filing process.

Common Questions

Who is required to file a South Carolina 1040ES form?

Every individual who expects the total amount of tax owed to be $1,000 or more when their income tax return is filed must file a South Carolina 1040ES form. This requirement applies to all individuals residing in the state, including nonresidents and part-year residents earning South Carolina taxable income. Exceptions include farmers and commercial fishermen meeting specific gross income criteria, residents and nonresidents who had no South Carolina tax liability for the previous year, and nonresident taxpayers doing business in South Carolina under certain conditions.

When are the filing deadlines for the South Carolina 1040ES vouchers?

The filing deadlines for the South Carolina 1040ES vouchers are April 15, June 16, September 15, and January 15 for individuals on a calendar year period. For fiscal year taxpayers, the vouchers must be filed on the 15th day of the 4th, 6th, and 9th months of the fiscal year, and the first month of the following fiscal year. Special dates apply if the requirement is met after specific periods within the year.

Can I make payments for the estimated tax all at once?

Yes, you can choose to pay all of your estimated tax on April 15, when the first installment is due. Alternatively, instead of making your last payment of estimated tax on January 15 (Voucher Number 4), you may file your completed income tax return by January 31 and pay in full the balance of all income tax owed. If there is any overpayment shown on the income tax return filed, it may be transferred to your estimated tax account for the next year.

How can joint declarations of estimated tax be filed?

A husband and wife living together may file a joint declaration of estimated tax. However, if they have different taxable years or if they choose to use different last names to maintain their own identity, they must file single or separate declarations. It's important to note that discrepancies between joint filings on SC1040ES vouchers and separate filings on Form SC1040 can lead to a deficiency or other notice, requiring clarification with the South Carolina Department of Revenue.

What should I do if my estimated tax needs to be amended?

If your estimated tax significantly increases or decreases due to changes in income, exemptions, or withholding, you should amend your declaration. No special form is needed for amending your declaration; simply use the regular declaration voucher for the filing period and submit it by the next filing date (April 15, June 16, September 15, or January 15).

What are the penalties for failing to file and pay estimated tax on time?

A penalty may be assessed for not paying enough estimated tax or for not making payments on time in the required amount. However, this penalty does not apply if each required payment is timely and the total tax paid is at least 90% of the total tax due. You can avoid a penalty by paying 100% of the tax shown due on your return for the preceding tax year, provided it was for a full 12 months. For individuals with an adjusted gross income of more than $150,000, the requirement increases to 110% of last year's tax liability. Use Form SC2210 to compute any penalty.

Common mistakes

Filling out the South Carolina 1040ES form for estimated tax payments can be a tricky process. Many fall into common pitfalls that may lead to errors or even penalties. To help navigate this process more smoothly, here are six mistakes to avoid:

- Incorrect Social Security Numbers: A very common mistake is entering incorrect Social Security numbers for oneself or a spouse. This can lead to processing delays or misapplied payments.

- Not Updating Personal Information: Failing to update personal information such as a new address can result in not receiving important correspondence from the Department of Revenue.

- Mismatched Names and Social Security Numbers: Names on the form must exactly match the names associated with the Social Security numbers provided. Discrepancies here can cause processing issues.

- Math Errors on the Worksheet: Math errors when calculating estimated tax can lead to underpayment or overpayment. Both scenarios have their drawbacks, potentially leading to penalties or a smaller refund than expected.

- Not Filing on Time: Missing the filing deadlines for the estimated tax vouchers can result in penalties. It’s crucial to mark your calendar for April 15, June 16, September 15, and January 15 (or the next business day if the date falls on a weekend or holiday).

- Payment Voucher Errors: Not using the correct payment voucher for the corresponding payment period or failing to include the voucher when sending a payment can delay the posting of paid taxes.

Avoiding these mistakes not only ensures compliance with South Carolina tax law but can also save taxpayers from unnecessary headaches and financial penalties. It's always a good idea to review the form carefully before submission, double-checking all information for accuracy.

Documents used along the form

When filing the South Carolina 1040ES form for estimated taxes, individuals often need to gather additional forms and documents to ensure a complete and accurate tax return. Understanding these documents can streamline the filing process and help avoid common pitfalls.

- Form SC1040: The South Carolina Individual Income Tax Return, which is the main form for reporting individual income tax in the state. It’s used to report income, calculate taxes owed, and identify any refunds due to the taxpayer.

- Form SC1040TC: This form is used for claiming tax credits that can reduce the amount of tax owed. It includes credits such as tuition, childcare, and other state-specific credits potentially available to the taxpayer.

- Form SC1040V: A payment voucher for those who owe tax and prefer to make their payment by check or money order. Using this form helps ensure that the payment is correctly applied to the taxpayer's account.

- Form SC1040X: Used for amending previously filed SC1040 forms. If a taxpayer realizes they made an error or omission on their original state tax return, they must file this form to correct the mistake.

- Form SC2210: Calculations for Penalties for Underpayment of Estimated Tax. Taxpayers who did not pay enough through withholdings or estimated tax payments must use this form to determine if they owe a penalty.

- Form SC W-4: The South Carolina Employee's Withholding Certificate, which determines the amount of state income tax to withhold from the employee's paycheck. Adjustments to withholding can help avoid owing tax or having too much withheld.

Together, these forms and documents support the main 1040ES form by detailing the taxpayer's income, withholding, and potential credits or deductions. Accurate completion and timely submission of these documents can aid in a smoother tax filing process and potentially avoid penalties or audits by providing a clear financial picture to the South Carolina Department of Revenue.

Similar forms

The Form 1040ES used by the IRS for estimated tax on the federal level is quite similar to the South Carolina 1040ES. The primary purpose of both documents is for individuals to calculate and pay their estimated tax quarterly when they do not have taxes withheld automatically from their income. Both forms necessitate the taxpayer to estimate their income, tax deductions, credits, and ultimately compute the tax due for the fiscal year, distributing this payment into four installments.

The South Carolina WH-1606 form, which is a Withholding Tax Deposit Form, shares similarities with the SC1040ES in its function related to tax payments. However, the WH-1606 form focuses on employers depositing the withholding taxes they have collected from employees' wages. Like the SC1040ES, this document ensures tax payments are made in a timely manner but differs in that it's the employer's responsibility, not the individual taxpayer's.

State Tax Voucher forms, like those used in other states for estimated tax payments, parallel the SC1040ES in purpose and functionality. These vouchers allow taxpayers from other states to submit their estimated tax payments. Each state has its own form, such as California's Form 540-ES or New York's IT-2105, but all serve to help residents and non-residents alike manage their estimated tax liabilities in a similar quarterly format.

The U.S. Federal 4868 form, an Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, while not a direct counterpart to the SC1040ES in terms of its primary function, has an indirect relationship in managing tax liabilities. The 4868 form enables taxpayers who cannot file their income tax return by the due date to avoid penalties by extending the filing deadline, affecting the estimated taxes owed.

The SC1040 Individual Income Tax Return form is directly associated with the SC1040ES, as the latter is essentially a preparatory step for the former. The SC1040 form is where taxpayers reconcile their actual earnings and taxes due for the tax year with their previously estimated payments made through SC1040ES vouchers, ensuring they've paid the correct amount of taxes.

The Schedule NR (Nonresident) form, used in conjunction with the SC1040 for non-residents of South Carolina, relates to the SC1040ES in the context of tax liability based on income sourced from South Carolina. Non-residents must estimate their income derived from the state, similar to how the SC1040ES requires residents to estimate their total income and taxes due for the year.

The W-4 form, Employee's Withholding Certificate, while primarily for determining the amount of federal taxes to be withheld from an employee's paycheck, indirectly affects the estimated taxes an individual might need to calculate using SC1040ES. By adjusting withholdings, taxpayers can influence the amount of estimated tax they need to pay, potentially lowering or eliminating the need for the SC1040ES payments.

The SC2210 Underpayment of Estimated Tax by Individuals form is closely related to SC1040ES since it deals with discrepancies in estimated tax payments. If a taxpayer underpays their estimated tax, the SC2210 form is used to calculate any penalties. It bases its calculations on the amounts entered in SC1040ES, underscoring the necessity of accurately estimating and paying taxes quarterly.

Dos and Don'ts

Filling out the South Carolina 1040ES form is important for meeting your tax obligations if you expect to owe $1,000 or more when you file your income tax return. Here are some essential dos and don’ts to keep in mind:

What you should do:

- Ensure Accuracy: Double-check your Social Security number, name, and address on the preprinted payment voucher. If they are incorrect, make the necessary corrections clearly.

- Compute Carefully: Use the Estimated Tax Worksheet provided to accurately estimate your tax. Utilize your previous year’s federal return as a starting point, but remember to adjust for any expected changes in your income or deductions.

- Meet Deadlines: Pay attention to the due dates for each installment—April 15, June 16, September 15, and January 15. If you’re starting your payment partway through the year, adjust your payments accordingly to catch up.

- Keep Records: Fill in the Record of Estimated Tax Payments section on the form to keep track of the payments you make. The Department of Revenue will not send a statement, so this will be your primary record.

What you shouldn’t do:

- Avoid Guesswork: Don’t make rough guesses about your income or deductions. Estimating too low could result in a penalty, while estimating too high could unnecessarily tie up your funds.

- Skip Payments: Don’t skip any of the installment dates if you’re required to make payments. Missing payments or paying late can result in penalties and interest charges.

- Ignore Changes in Income: If there’s a significant change in your income or deductions during the year, don’t continue making payments based on outdated estimates. Amend your 1040ES accordingly.

- Delay Corrections: If you notice errors on your preprinted voucher or if your financial situation changes, don’t wait until the next payment period to make corrections. Address them promptly to avoid future complications.

Following these dos and don’ts can help streamline the process of filing your South Carolina 1040ES form, ensuring compliance with state tax requirements while minimizing potential issues. Always stay informed about any changes to tax laws that may affect your estimated tax payments.

Misconceptions

When it comes to understanding the South Carolina Form SC1040ES for declaring estimated tax, there are several common misconceptions that can lead to confusion or errors in filing. Let’s clarify a few of these misconceptions to ensure you have the right information moving forward.

- Only self-employed individuals need to file Form SC1040ES: A common misconception is that only self-employed people need to worry about estimated tax payments. In reality, anyone expecting to owe $1,000 or more in taxes when their return is filed should submit estimated tax payments. This includes not only the self-employed but also individuals receiving income without withholdings, such as some retirees or those with investment income.

- Estimated payments are based solely on this year's income: While it's true that estimated tax payments are generally based on your current year's income, there are other methods to calculate what you should pay. One method involves paying 100% of your prior year's tax liability (110% if your adjusted gross income is over $150,000), which can serve as a safe harbor to avoid penalties, regardless of your current year income.

- Penalties are unavoidable if you underpay estimated taxes: It is indeed possible to incur penalties for underpayment of estimated taxes. However, these penalties can often be avoided if you pay at least 90% of your current year's tax liability or meet one of the safe harbor provisions, such as paying 100% of your previous year's liability. Additionally, there's no penalty for underpayment due to reasonable cause if you can demonstrate that you acted in good faith.

- The payment schedule is inflexible: While there are four standard due dates for making estimated tax payments (April 15, June 15, September 15, and January 15 of the following year), there are situations where these dates can be adjusted. For example, taxpayers who realize they have underestimated their taxes partway through the year can catch up on their payments to minimize or avoid penalties. Furthermore, special rules exist for those who receive income unevenly throughout the year, allowing them to make payments that better match their cash flow.

Understanding these aspects of the South Carolina Form SC1040ES is crucial for making accurate and timely payments, thus avoiding unnecessary penalties. Always refer to the latest guidance provided by the South Carolina Department of Revenue to ensure compliance.

Key takeaways

Filing a South Carolina Form SC1040ES is necessary for individuals who expect their tax owed to be $1000.00 or more when they file their income tax return. This includes residents, nonresidents, and part-year residents with South Carolina taxable income.

Quarterly payments are typically due on April 15, June 16, September 15, and January 15. However, for certain taxpayers such as farmers and commercial fishermen, there is an option to pay all estimated tax by January 15 or file the return and pay in full by March 1 to avoid quarterly payments.

Residents with no South Carolina tax liability for the previous year and who had a return for a full 12 months, or would have had one, are exempt from filing a declaration.

Estimated tax payments can be avoided by adjusting withholdings on your earnings. For instance, you can file a new withholding exemption certificate to have more state tax withheld from your paycheck.

Couples living together may file a joint declaration of estimated tax, but certain conditions may necessitate filing separately, such as different taxable years or preference to retain individual identities through different last names.

Amending your declaration is necessary if the estimated tax changes significantly due to variations in income, exemptions, or withholding. This adjustment should be made before the next filing date after noticing the change.

A penalty for failing to file or pay the estimated tax on time can be avoided if 90% of the total tax due is paid through the estimated payments. The penalty may also be avoided by paying 100% of the previous year's tax liability, or 110% for individuals with adjusted gross income of more than $150,000.

The payment-voucher provided must be used to ensure accurate posting of payments. It requires checking that your name, address, and Social Security number are correct. If using a preprinted voucher, corrections must be typed or clearly printed if any errors are found.

More PDF Templates

South Carolina Retirement - Form 1102 is used by South Carolina Retirement Systems participants to specify who will receive benefits in the event of their death.

South Carolina Sales Tax Form - Features sections for calculating penalties and interest for late filings or payments.